An independent elementary school located in Atlanta, serving children ages three through Sixth Grade since 1951.

Planned Giving

Planned Giving

Planned Giving

List of 5 items.

Gifts of Stock or Appreciated Securities

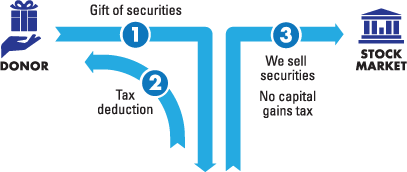

How It Works

- You transfer appreciated stocks, bonds, or mutual fund shares you have owned for more than one year to Trinity School.

- Trinity sells your securities and uses the proceeds for our programs.

Benefits

- You receive an immediate income tax deduction for the fair market value of the securities on the date of transfer (even if you originally paid much less for them).

- You pay no capital gains tax on the transfer when the stock is sold.

- Giving appreciated stock can be more beneficial than giving cash. The "cost" of your gift is often less than the deduction you gain by making it.

Next

- Frequently asked questions on gifts of stock.

- Contact us so we can assist you through every step.

© 2026 Trinity School. All Rights Reserved

4301 Northside Parkway Atlanta, GA 30327

Email: info@trinityatl.org | Phone: 404.231.8100

Fax: 404.231.8111

Email: info@trinityatl.org | Phone: 404.231.8100

Fax: 404.231.8111